Integrate E-Invoices with your ERP

Use GSTZen for GST and E-Way Bill Reconciliation and Reports, filing GST Returns, various useful tools and for complete E-invoice support.

E-Invoicing

With the Government mandating E-Invoicing, GSTZen is creating E-Invoicing solutions for various ERPs and Billing systems such as Tally, SAP, Oracle, Microsoft Dynamics, etc. GSTZen will also be able to help you integrate with your In-House or Custom ERP in order to create E-Invoices. If you are using any of these systems, you can get started right away. You may read our documentation on How to prepare your business for eInvoicing for more details.

To help with E-Invoicing on your custom software or ERP, take a look at GSTZen's E-Invoicing Schema and test it out. Get in touch with us if you need more help in getting started.

You may also read our articles on GSTZen E-Invoicing Integrations for Demo and E-Invoice sample

GST and E-Way Bill Reports

GSTZen is one of the best GST software out there mainly because of the quality of its Excel-based reports. Quick, accurate, and flexible reports let you view and analyze your GST and E-Way Bill data along various dimensions. Download the sample reports shown below and decide for yourself.

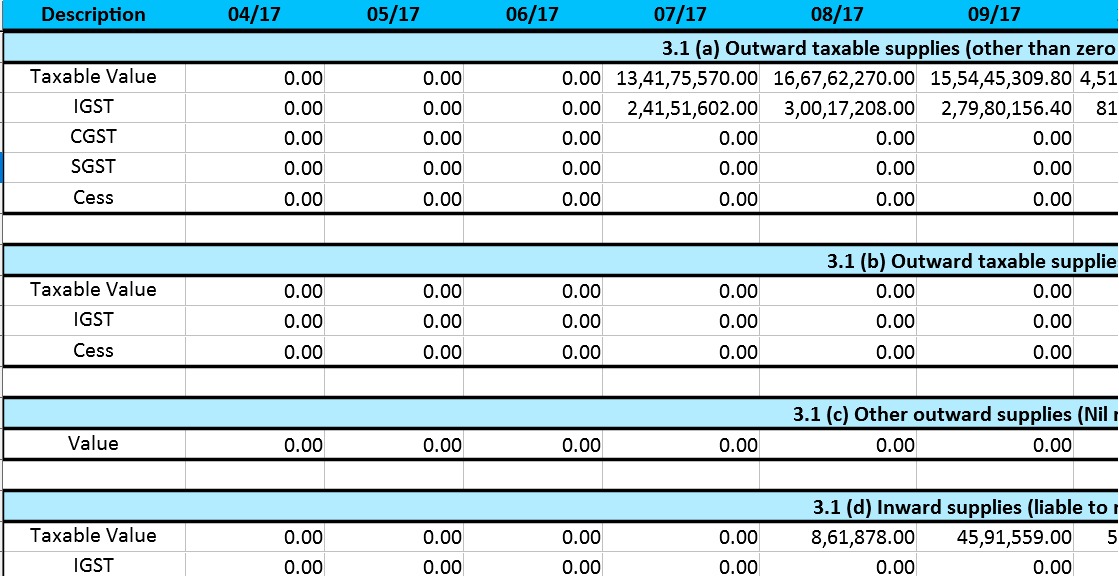

GSTR-1 vs GSTR-2A vs GSTR-3B YTD Report (including GSTR-9)

Within five minutes, you can generate and download a consolidated report of your full year data. This comprehensive report presents data in your GSTR1, GSTR2A, and GSTR3B returns along with your Sales and Purchase Registers. The report compares GSTR1 to GSTR3B to help check whether they are consistent. Compare GSTR3B to GSTR2A to keep a check on the ITC that you are claiming.

- Year-to-date GSTR-1 vs 2A vs 3B with auto-populated GSTR-9

- PAN-level Year-to-date GSTR-1 vs 2A vs 3B (of all GSTINs within a PAN)

- PAN-level Monthly Report (of all GSTINs within a PAN)

Purchase Register (Books) vs GSTR-2A Auto-Reconciliation

Save time by using the best GST reconciliation software. Reconcile your Purchase register with Government portal data using GSTZen's Intelligent GSTR-2A Matcher. GSTZen's matcher program handles various cases such as differences in invoice numbers, dates and amounts and gives the best possible matching. Know which suppliers have not uploaded their invoices and send them email reminders and claim your ITC.

E-Way Bill Report

Do not wait to receive a notice from your officer to check what E-Way Bills you have generated. You can download details of all your E-Way Bills within a few minutes and analyze them in Excel format. Compare E-Way Bills to your Invoices and GSTR-1 to ensure that you always compliant.

Customer and Vendor Return Filing Status

In order to claim Input Tax Credit, the CGST Act Section 42 makes it a recipient's responsibility to ensure that their suppliers have filed their GST returns. Also, a supplier cannot generate E-Way Bills against their customers if their customers have not filed their GST Returns. GSTZen provides you with filing details of your suppliers and customers in a handy Excel Report.

Tally Integration

Reconciling GSTR 2A with your Books has never been easier. GSTZen's Seamless Tally Integration helps you directly upload your Purchase Invoices into GSTZen through Tally.

Read our article on Seamless Tally Integration for the procedure to upload Tally Purchase Ledgers into GSTZen in 4 simple steps.

Filing your GST Returns

Join thousands of tax payers who experience a smooth return filing experience. With GSTZen, you do not have to handle and convert JSON files or wait for the Government Portal to validate your tax return details. GSTZen comes with hundreds of validation checks to save you time and effort.

GSTR-1 Returns filing with GSTZen

GSTR-1 filing with GSTZen is fast because you can simply upload your sales register and GSTZen will directly upload your return to the Government Portal. GSTZen's built-in validations catches most errors that you are likely to face if you try to file the return on your own.

GSTR-3B - Monthly Return

CGST Rule 36(4) limits tax payers to avail Input Tax Credit only against invoices uploaded by their suppliers. GSTZen auto-fills your GSTR-3B based on your Books of Accounts, full year GSTR-2A, and full year GSTR-3B, in compliance with the 20% Rule. File your GSTR-3B with confidence and stay fully compliant.

GSTR-9 - GST Annual Return

GSTZen's consolidated report auto-populates your GSTR-9 Annual Return based on details in your monthly returns. You can make changes and run through dozens of validations to ensure that you make no mistakes while filing your GSTR-9.

GSTR-9C Annual Return and Reconciliation

GSTZen is the only software to support the GSTR-9C Audit form. We guarantee you ZERO errors if you use GSTZen to file your GSTR-9C. Instead of dealing with technical issues with the offline tool and the government portal, focus on what should go into your return and file your GSTR-9C in 20 minutes or less.

New Returns - ANX-1, ANX-2, and RET-1

With GSTZen, there is nothing new for you to learn when filing the new GST returns. Simply upload your invoices and GSTZen will take care of the rest.

GSTZen Chrome Extension

GSTZen Chrome Extension displays information about a Tax payer (GSTIN) such as Return filing status, GSTR 3B Summary, Electronic Ledger Balances; all in one console.

Read our article on GSTZen Chrome Extension to know more about how to use the tool.

Useful GST Tools

GSTZen comes with lots of simple and easy to use software tools that do not require any login or account. These tools are handy to validate your data, convert reports into excel.

JSON to Excel Converters

Convert your JSON files to Excel using GSTZen’s converters. GSTZen has converters for GSTR-1, GSTR-2A, GSTR-9, ITC-04, GSTR-4A, GSTR-6, ANX-1, and ANX-2 return formats.

Generate E-Way Bill with GSTZen

Generate E-Way Bills using GSTZen software.

Taxpayer Search for GSTR filed dates and GSTIN details

The Tax Payer search link will enable you to search for a Tax Payer's information using their GSTIN, PAN number, or Tax Payer Name. This link will give you the Tax Payer's Return filing status such as GSTR 3B filed date and details of the GSTIN.

GST Number Validator

A common error that users face while filing GST Returns is incorrect format of GSTIN number. Check the correctness of GST numbers in bulk and save yourself a lot of time.

HSN/SAC Code Validator

The validation of HSN and SAC codes in GSTR9 Annual Return and the New Returns is very strict. Check HSN and SAC codes in your data in bulk using GSTZen's HSN and SAC Code Validator

GST Interest and Late Fee Calculator

Keep track of GSTR1 and GSTR3B due dates and file your returns on time. We hope you never have to use the Interest and late fee calculator, which quickly helps you calculate any interest or late fee that you have to pay.